Over the past few years, like many other investors, we have become fluent in the language of greenhouse gas emissions. As a reminder, Scope 1 emissions are those that a company directly owns and controls (coal in your power plant, fuel in your car). Scope 2 emissions are indirect (electricity supplied to your office or shop). So far, it’s relatively simple, but a third dimension in the form of Scope 3 emissions is where things get a bit more complicated.

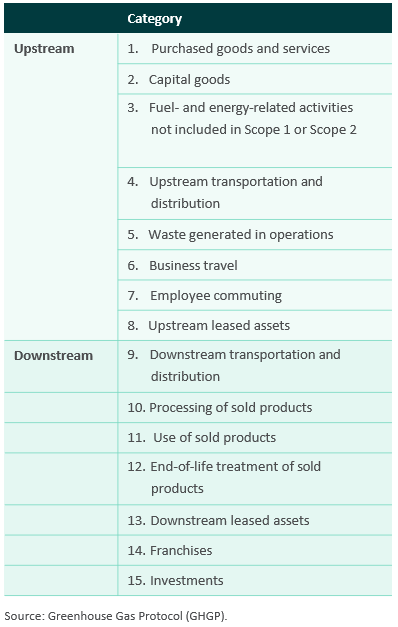

We discussed data challenges in our Sustainability Review last year and highlighted the wide range of Scope 3 numbers that different data providers will produce for the same company. The challenge starts with an array of different Scope 3 emissions categories (see Figure 1).

Figure 1. Scope 3 categories

Scope 3 includes straightforward items such as the emissions produced from a company’s business travel, which should be relatively easy to measure. Some items are more difficult to calculate, however, such as emissions from a company’s third-party suppliers. And the ‘use of sold products’ category, an attempt at measuring the energy consumed by the end customer when they use a company’s product, presents a significant challenge.

A good example is Unilever, one of our portfolio holdings and a large Scope 3 emitter. Part of the reason for its high Scope 3 figure is that Unilever estimates the energy used in heating water every time you use their Dove shower gel. This clearly involves estimates such as how long you shower, how hot you like your shower and how often you shower. A wide range of outcomes is inevitable.

Given the breadth of underlying assumptions used in calculating this data, it is only natural to question its value. Boiling complex issues down into simple statistics should always come with a health warning – many small uncertainties multiplied together can yield significant aggregate uncertainty. Our preference is to heed the aphorism that ‘all models are wrong – but some are useful’.

Seeking to understand risk and uncertainty is fundamental to planning for an outlook beyond our forecasting horizon and is why we also look for management teams and businesses that have demonstrated both adaptability and resilience in the past, and an open-minded attitude to the future.

Saints not sinners

Looking across our portfolio, there are some companies that look bad but actually do good. WEG is a Brazil- based global manufacturer of electric motors used in products ranging from small kitchen appliances to large wind turbines.

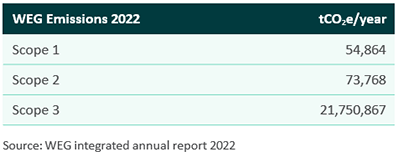

WEG began reporting Scope 3 emissions in 2021 and, on first inspection, their latest (2022) number is eye-watering: 21.75 million tonnes of CO2 equivalent (see Figure 2).

Figure 2. WEG emissions (tCO2e/year) 2022

As noted above, Scope 3 emissions include customer use of all goods and services that a company sells. Every time you use your washing machine, for example, you might be powering a WEG electric motor and thus consuming energy and creating emissions that fall under Scope 3 for WEG. The company has told us that 70% of energy consumption involves an electric motor.

Focusing on Scope 3 emissions ignores the fact that WEG’s products are continually becoming more efficient and that they may often be replacing a carbon-intensive combustion engine. Aside from wind power, WEG is developing products used in solar energy, gravitational storage projects and electric vehicle batteries. WEG is not quite the menace to society that its Scope 3 emissions number implies.

Emissions avoided

Clearly, developing a less power-hungry motor for a washing machine should be treated as a positive for the world. Proof that WEG is good may come in the form of Scope 4 emissions data, which estimates the ‘avoided emissions’ of a company’s projects and products. It’s not compulsory to report Scope 4 figures, but many companies choose to do so. Like Scope 3, Scope 4 emissions are not easy to calculate, again involving a number of assumptions about how often an end product is used. But were WEG to calculate it, which they are looking into, their Scope 4 emissions would probably offset some, if not all, of their Scope 1, 2 and 3 emissions.

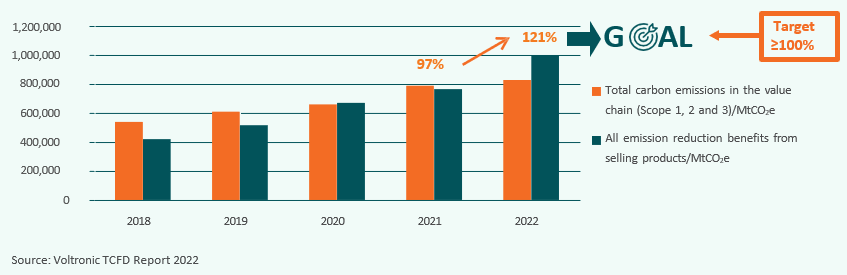

Another of our portfolio holdings does attempt to measure its avoided emissions. Voltronic, based in Taiwan, makes uninterruptible power supply (UPS) products, photovoltaic (solar) inverters and energy storage systems. They stress in their sustainability reports that the products they make are all aimed at reducing the carbon emissions of their end customers, through either improved energy efficiency or direct use of renewable energy.

Voltronic calculates the ‘emission reduction benefits’ (ERB) of its product sales, which we believe is akin to Scope 4 avoided emissions. The big caveat when we look at these numbers is that it’s not very clear exactly how they’re calculated. However, the ERB figure for 2022 is greater than Voltronic’s own total emissions (Scope 1, 2 and 3). Effectively that means that Voltronic is already net zero.

Figure 3. Voltronic emission reduction benefits

The relationship chart of all emission reduction benefits from selling products vs. total carbon emissions in the value chain:

Conclusion

At Skerryvore we always look to understand the why, not just the what. Despite the obvious flaws we’ve discussed in the data, analysing Scope 3 and Scope 4 emissions is an instructive exercise. As a starting point, it should help catch out those companies that are greenwashing by outsourcing what were once their own Scope 1 and 2 emissions to a third-party supplier. In the transition to a low-carbon economy, it also highlights that companies like WEG and Voltronic are part of the solution, not the problem. And finally, it might well also encourage some of us to take a cold shower once in a while!