The mountains are high and the emperor is far away

This ancient Chinese proverb is often used to depict the Chinese Communist Party’s authority becoming steadily more diluted the further one gets away from Beijing. As risk-aware emerging market investors, government interference is something that the investment team likes to keep ‘far away’.

It was with this in mind that team members took a trip to China this spring, avoiding Beijing and instead focusing on a cohort of privately owned medium-sized companies in cities such as Shenzhen, Guangzhou, Shanghai, Hangzhou, Hefei and Changsha.

Many of these companies are listed on the local ‘A-share’ markets and have become available to international investors only in the past decade, since the introduction of the Hong Kong Stock Connect scheme in 2014. Further stock market reforms prompted the index provider MSCI to begin a staged addition of China A-shares to the Emerging Market Index in 2018.

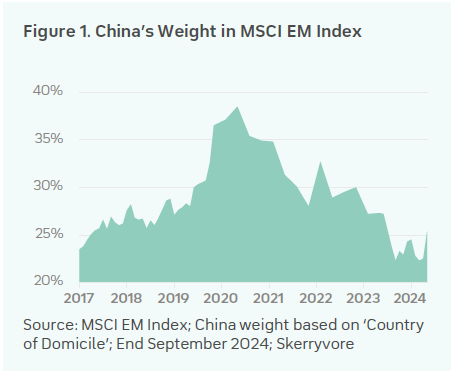

Coupled with the growing popularity of Chinese internet companies listed in the US and Hong Kong, this meant asset allocators scrambled to increase their exposure to Chinese equities, providing plenty of support for equity market valuations. Indeed, such was their popularity that the weight of China in the MSCI Emerging Markets Index reached circa 40% at its peak in October 2020 (Figure 1).

Enthusiasm for Chinese equities became somewhat detached from the reality of what was happening on the ground. Economic growth was slowing and fears were rising over high debt levels at property companies and local governments. Earnings growth was consistently below expectations, making equity market valuations difficult to justify. An ensuing property market collapse and extended Covid-19 lockdowns led to further disappointment. The MSCI China Index fell more than 50% from the peak, with China’s weight in the EM benchmark now sitting at 25%.

These extreme moves partly explain why we at Skerryvore ignore index weights. Fundamentally we don’t believe that the benchmark is a sensible way to allocate capital, and the benchmark is backward-rather than forward-looking. The good news, though, is that this dynamic can sometimes create opportunities to buy good-quality companies at reasonable prices. Our China trip uncovered a variety of businesses whose valuations have fallen dramatically from the dizzy heights they traded at in 2020.

However, we start with two important general observations about supply and demand.

Oversupply is everywhere

In our view, real estate is an example to the outside world of an industry suffering from oversupply. We drove past vast blocks of towers in smaller cities like Hefei, many of which looked like they had been abandoned for quite some time. We also met kitchen appliance companies in Hangzhou that had as little insight into where the property market would bottom out as an outside observer. Only now are we starting to see developers being put through bankruptcy proceedings, which is perhaps the start of the long path to recovery.

Logos are protected trademarks of their respective owners and Skerryvore Asset Management disclaims any association with them and any rights associated with such trademarks.

What we found more interesting, however, was the excesses we saw in industries such as solar panels, lithium batteries and autos. Chasing growth in these markets has led to questionable capital allocation decisions. One second-tier electric vehicle (EV) battery manufacturer, the partner of a large European original equipment manufacturer (OEM), stated to us it would not hesitate to spend whatever it takes to keep up with the industry. Having already spent almost six times the company’s cumulative historic operating cash flow expanding its capacity over the past two years, in our view, shareholder returns are clearly not top of the agenda.

Our other striking observation was the breadth of EV brands on show – there are still around 100 Chinese electric-car makers, down from roughly 500 in 20192. We encountered dozens of these brands on the roads or on display in shopping malls, where they all boasted impressive specifications and price tags that make it difficult to see how western brands could ever compete. Although EV sales are still growing in China, overall auto sales are falling. Factor in lower subsidies, rising tariffs and a falling export market and, again, it feels likely this will not end well for investors.

Consumer businesses challenged by both demand and supply issues

An area that typically proves a fruitful hunting ground for our philosophy is consumer goods, where brand loyalty and distribution are effective ingredients for generating high returns.

The emergence of Douyin, the Chinese version of TikTok, as the second-largest ecommerce site in China has meant that traditional marketing methods have had to be rethought3. The old advantages of physical distribution and in-store promotion have been negated and live-streaming product demos are now where the battles for wallet share are being fought. This is just as apparent in higher-value items like skincare and cosmetics as it is with more mundane purchases such as laundry detergent.

Barriers to entry for starting a consumer company have therefore fallen dramatically. We saw this on full display when we visited a listed snacks company whose headquarters were on the top floor of a skyscraper in Changsha. Our visit revealed that they shared the building with nine other competing snacks companies!

A heightened competitive environment is exacerbated by two other trends. First, downtrading – i.e. choosing lower-cost items. Lower consumer confidence, impacted by falling property prices, is resulting in the Chinese spending more frugally. Discount stores are one of the few growth areas of bricks and mortar retail. Second, the Chinese consumer is fickle. Keeping a customer loyal to your brand can be difficult when so many other options are available.

Attractive niches can still be found

Ultimately, these issues of heightened competition and the resulting oversupply mean many businesses we encountered would fail our ultimate test of franchise quality – few exhibited signs of sustainable pricing power. However, it wasn’t a wasted trip.

The more interesting companies to us were founder-owned businesses, far removed from state interference and perhaps characterised as operating in unglamourous sub-sectors with less competition. We met an array of industrial companies that had built businesses on solid reputations and are competing on a par with best-in-class global peers.

These included a producer of sorting and inspection machines used in agriculture and food processing, a manufacturer of temperature-control equipment used in telecommunications infrastructure and a leading domestic player in industrial compressors and vacuum pumps. All three of these businesses had built leading domestic market shares through a reputation for the quality of their products and after-sales service and were gaining share internationally in their fields. Importantly, they had preserved strong balance sheets, implemented stock ownership plans for their employees and had track records of growing dividends.

Another area that provided ideas for further work was the healthcare sector. With an aging population and recent memories of the pandemic still to the fore, the emphasis is on growing self-reliance in areas such as innovative drugs, medical equipment and diagnostics.

One of the best examples we came across was China’s leading manufacturer of patient-monitoring diagnostic systems. Despite rising geopolitical tensions, its equipment is an increasing presence in hospitals globally, and the company has shown an ability to successfully expand its product offering into other areas of medical devices. It also now trades on a far more palatable valuation, with its share price almost halved from its peak.

Conclusion

Back when China was more popular our low exposure to the country meant we were often questioned about whether we had an unconscious bias against the opportunity set within the country. Our investment philosophy does rule out large swathes of the Chinese equity market, including state-owned enterprises (SOEs), variable-interest entities (VIEs) and other politically exposed or dependent businesses. It’s fair to say that these are more prevalent in the Chinese market than in many other countries4.

However, this doesn’t rule out all Chinese equities. When we established Skerryvore in 2019 we simply couldn’t find good-quality businesses trading at valuation levels that met our absolute return-based requirements. There are pockets of the Indian market today where we would say the same.

While our first trip to China post Covid-19 has raised our required return for some industries (consumer, solar, EV), we uncovered plenty of privately owned, first-generation founder-run businesses with good records of generating returns for minority shareholders.

A difficult economic backdrop has sent share prices tumbling across China. In equity markets it is often darkest before the dawn. This often creates opportunities to buy quality businesses at discounted valuations. Having added new companies to our watchlist on the back of the trip, we feel well placed to take advantage of valuation opportunities that become available.

1. Chinese proverb thought to have originated from Zhejiang during the Yuan dynasty. https://en.wikipedia.org/wiki/Heaven_is_high_and_the_emperor_is_far_away

2. Bloomberg News (17 August 2023). China’s abandoned electric cars pile up after EV boom fuelled by subsidies. www.bloomberg.com/features/2023-china-ev-graveyards

3. Kantar Worldpanel (28 June 2024). China’s FMCG sector settles into low growth reality. www.kantarworldpanel.com/cn-en/news/China-Shopper-Report-2024-Vol1-EN

4. Hissey, Ian (17 December 2019). "Investing in Chinese State-Owned Enterprises". insight.factset.com.

Any information provided in this document relating to specific companies/securities should not be considered a recommendation to buy or sell any particular company/security.